Irs Quarterly Estimated Tax Payments 2025

Irs Quarterly Estimated Tax Payments 2025

Estimated (quarterly) tax payments calculator. The irs requires estimated tax payments to be made quarterly.

The irs requires estimated tax payments to be made quarterly. Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2025 if both of the following apply:

Filers May Owe Estimated Taxes With.

We’ll break down everything you need to know about irs estimated tax payments, the quarterly tax.

Estimated Tax Is Used To Pay Not Only Income Tax, But.

Estimated quarterly tax payments are exactly what they sound like:

Images References :

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

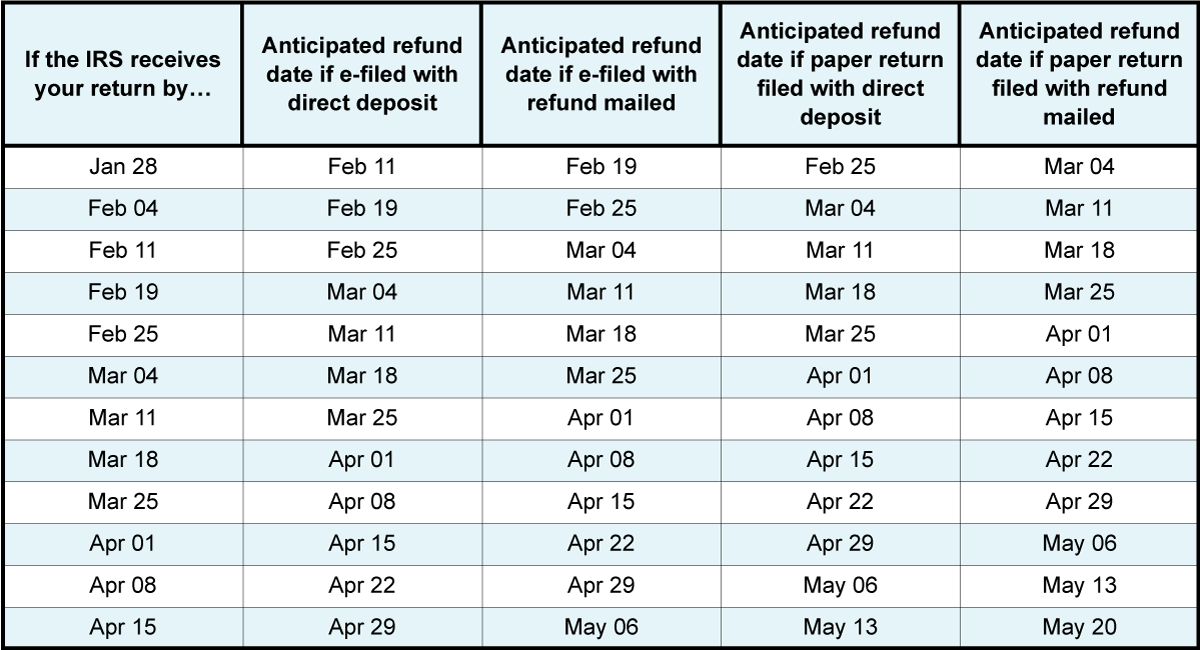

2025 Irs Quarterly Payments Elana Harmony, As a result, the first estimated tax payment deadline for the 2025 tax year (april 15, 2025) has been pushed back to june 17, 2025, for victims of the following. Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments.

Source: lindaramey.pages.dev

Source: lindaramey.pages.dev

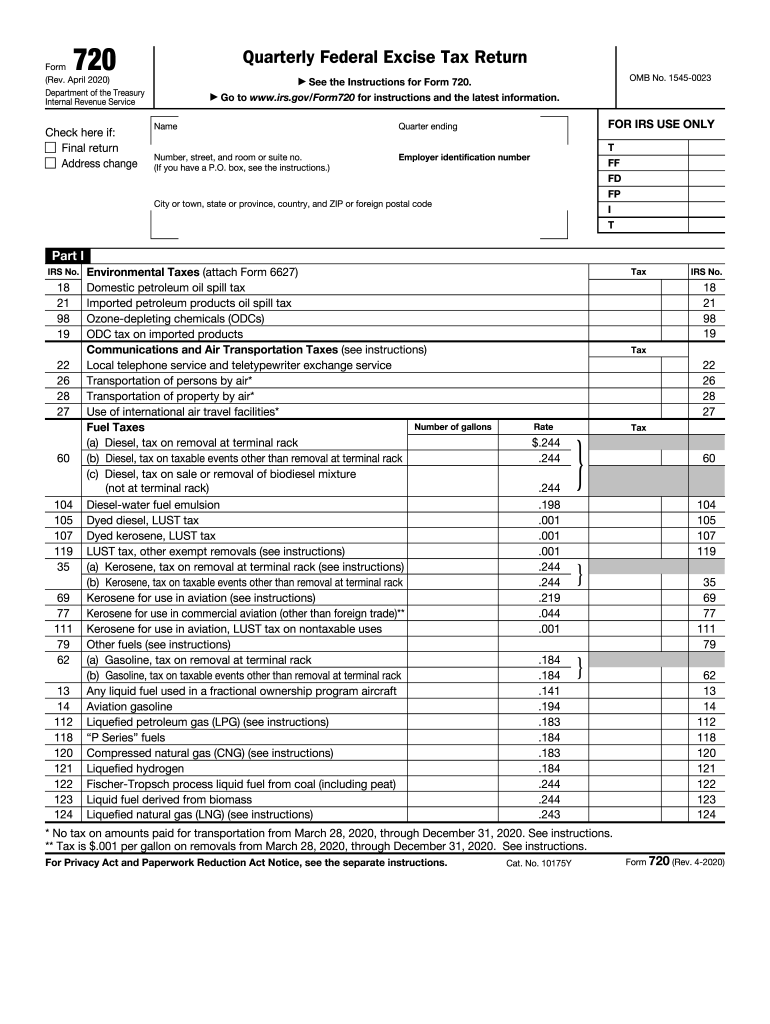

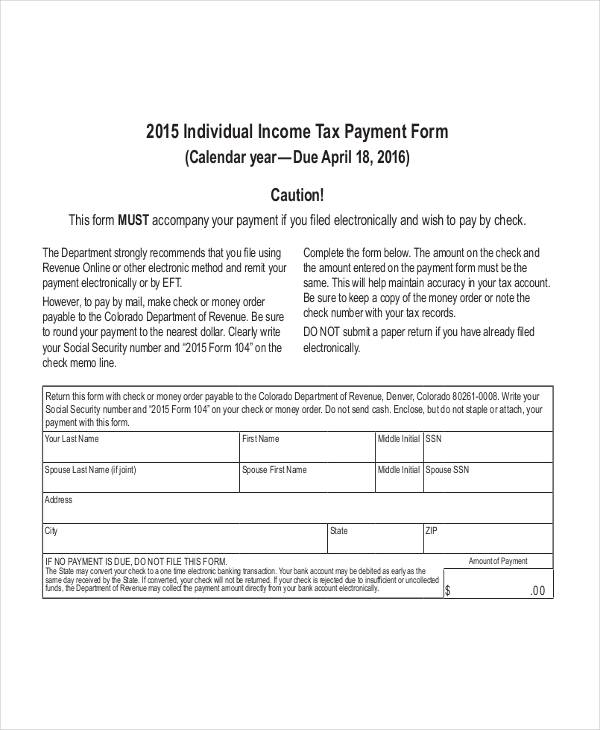

Irs Form For Quarterly Taxes 2025 Neala Viviene, If you struggled with your estimated tax payments in 2025, this guide is for you. Go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax.

Source: www.dochub.com

Source: www.dochub.com

Irs form quarterly Fill out & sign online DocHub, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Estimated Tax Due Dates 2025 Form 2025Es 2025 Angele Valene, When are business estimated tax payments due in 2025? Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Irs Quarterly Tax Payments 2025 Schedule 1 Kali Samara, The irs requires estimated tax payments to be made quarterly. Estimated tax is used to pay not only income tax, but.

Source: ronaldjohnson.pages.dev

Source: ronaldjohnson.pages.dev

2025 4th Quarter Estimated Tax Payment Gabey Shelia, Tax payments an individual makes to the irs on a quarterly basis, based on estimates of. The irs' current penalty assesses an 8% interest charge for underpayments, compared with 3% in 2021, when the fed's benchmark rate was close to zero.

Source: lorrainekaiser.pages.dev

Source: lorrainekaiser.pages.dev

How Do I Calculate My Estimated Taxes For 2025 Hanny Kirstin, Making estimated tax payments on time has benefits beyond maintaining compliance. Tax payments an individual makes to the irs on a quarterly basis, based on estimates of.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Irs Estimated Tax Payments 2025 Due Dates Fionna Beitris, Estimated tax is used to pay not only income tax, but. Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2025 if both of the following apply:

Source: kimwmelton.pages.dev

Source: kimwmelton.pages.dev

When Are Irs Estimated Taxes Due In 2025 Kiah Arlinda, If you struggled with your estimated tax payments in 2025, this guide is for you. As a result, the first estimated tax payment deadline for the 2025 tax year (april 15, 2025) has been pushed back to june 17, 2025, for victims of the following.

Source: ronaldjohnson.pages.dev

Source: ronaldjohnson.pages.dev

Irs Quarterly Estimated Tax Payments 2025 Due Date Shir Yvette, Tax payments an individual makes to the irs on a quarterly basis, based on estimates of. Generally, the internal revenue service (irs) requires you to make quarterly estimated tax payments for calendar year 2025 if both of the following apply:

Making Estimated Tax Payments On Time Has Benefits Beyond Maintaining Compliance.

Estimated quarterly tax payments are exactly what they sound like:

The Irs Requires Estimated Tax Payments To Be Made Quarterly.

Not all freelancers and independent.