2024 Section 179 Deduction

2024 Section 179 Deduction. Section 179 of the irs tax code allows for a tax deduction on business expenses related to buying equipment during the tax year. The irs today released rev.

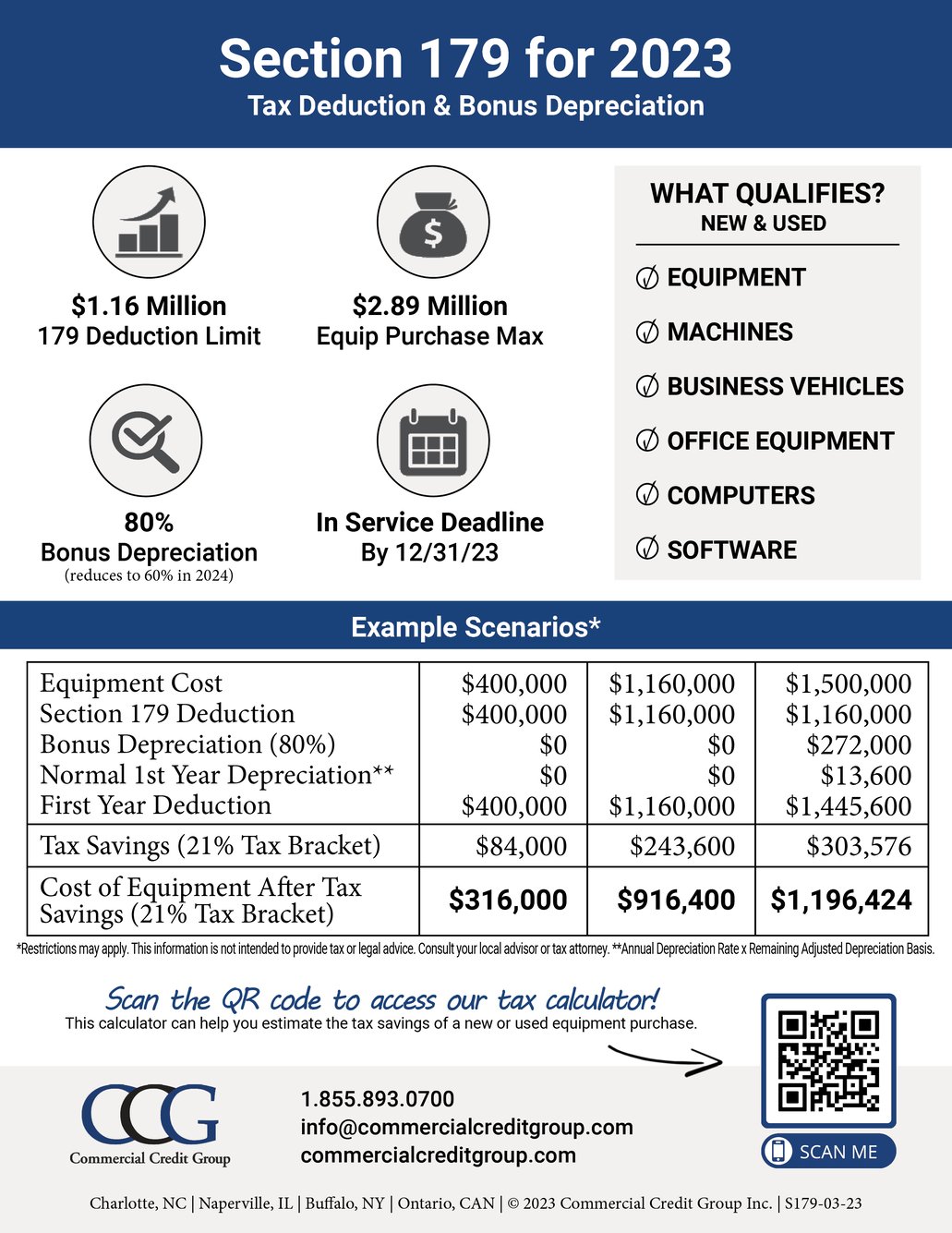

The section 179 deduction is a tax deduction in the united states, designed to incentivize businesses to invest in their growth and development. In 2024, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023).

Claiming Section 179 Depreciation Expense On The Company’s Federal Tax Return Reduces The True Cost Of The Purchase To $130,000 (Assuming A 35%.

The 2024 section 179 deduction is $1,220,000, which is $60k higher than it was in 2023.

This Is The Largest Deduction The Irs Has Ever Offered Small Businesses.

Dock treece, business strategy insider and senior writer.

The Section 179 Deduction Is A Tax Deduction In The United States, Designed To Incentivize Businesses To Invest In Their Growth And Development.

Images References :

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, Be within the specified dollar limits of section 179. Section 179 deduction vehicle list 2024.

Source: www.balboacapital.com

Source: www.balboacapital.com

Section 179 Property Guide for 2024 Balboa Capital, Which vehicles are eligible for. The section 179 deduction is a tax deduction in the united states, designed to incentivize businesses to invest in their growth and development.

Source: www.masontractor.com

Source: www.masontractor.com

Section 179 Deductions » Mason Tractor Co., What is the section 179 tax deduction? Under the 2024 version of section 179, businesses cannot deduct more than $1,220,000 in assets.

Source: www.balboacapital.com

Source: www.balboacapital.com

Section 179 Tax Deduction For 2024 Balboa Capital, This means your business can now deduct the entire cost of. Section 179 tax deduction for 2024 balboa capital, section 179 of the irs tax code lets a business deduct the full purchase price of qualifying equipment within the year it’s.

Source: vevhilao.blogspot.com

Source: vevhilao.blogspot.com

8+ Section 179 Deduction Vehicle List 2022 Everything You Need To, In 2024, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023). The section 179 deduction is a tax deduction in the united states, designed to incentivize businesses to invest in their growth and development.

Source: www.grofftractor.com

Source: www.grofftractor.com

Section 179 Tax Deduction Groff Tractor Equipment, Under the 2024 version of section 179, businesses cannot deduct more than $1,220,000 in assets. Eligible vehicles must exceed 6,000 gvwr and can include different car categories, like trucks, vans, and suvs.

Source: www.equipmentradar.com

Source: www.equipmentradar.com

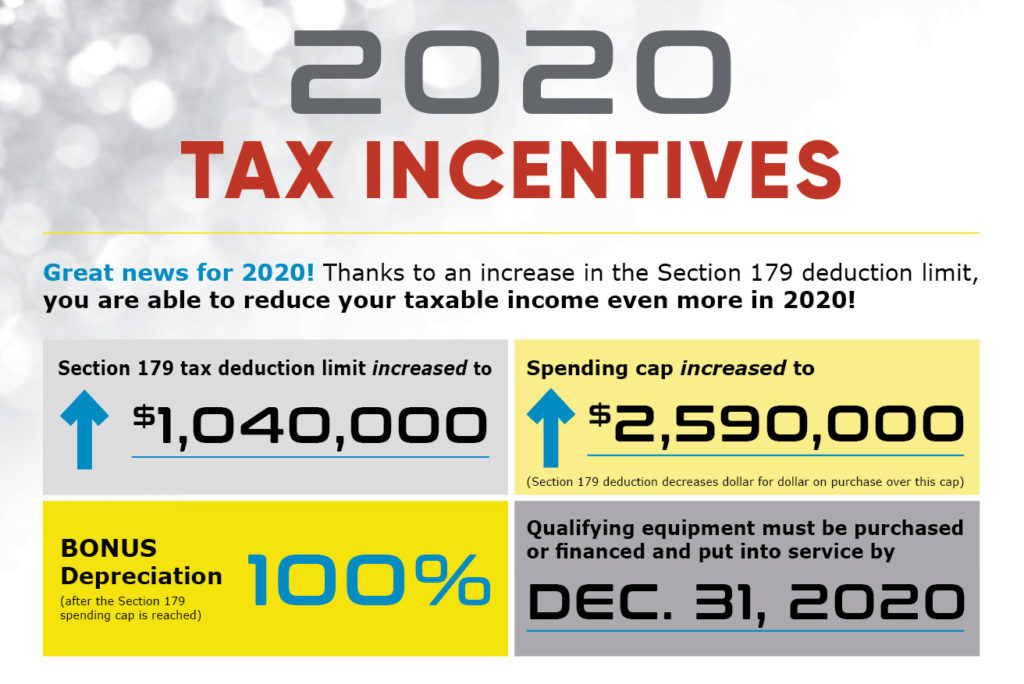

2021 Section 179 Deduction Calculator & Guide For Equipment Equipment, In 2024, it rises to $1,220,000. This change is part of the.

![Section 179 Deduction [2020 Guide] Dump Truck Exchange](https://dumptruckexchange.com/wp-content/uploads/2020/11/Section_179_Deduction_2020.jpg) Source: dumptruckexchange.com

Source: dumptruckexchange.com

Section 179 Deduction [2020 Guide] Dump Truck Exchange, The section 179 deduction is a tax deduction in the united states, designed to incentivize businesses to invest in their growth and development. For 2023, the deduction limit is us$1,160,000 if you purchase $2.89 million or less of trucks.

Source: www.taxuni.com

Source: www.taxuni.com

Section 179 Deduction 2023 2024, The section 179 deduction is a tax deduction in the united states, designed to incentivize businesses to invest in their growth and development. Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35%.

Source: section179.small-business-resource-network.org

Source: section179.small-business-resource-network.org

Section 179 Deduction Non Qualifying Property Understanding The, Section 179 tax deduction 2023 2024, claiming section 179 depreciation. Under the 2024 version of section 179, businesses cannot deduct more than $1,220,000 in assets.

In 2024, Bonus Depreciation Is 60% For.

This is the largest deduction the irs has ever offered small businesses.

Dock Treece, Business Strategy Insider And Senior Writer.

What is the section 179 tax deduction?